The leadership of the Ghana Co-operative Credit Unions Association (CUA) has appealed to President Akufo-Addo’s administration to take urgent steps to have their locked-up funds as a result of the banking sector cleanup released to its struggling members.

The CUA says its members have one hundred and eighty million, eight hundred and six thousand, eight hundred and ninety Ghana cedis (GHc 180,806,890.60), locked up in thirty-one (31) financial institutions.

Twenty-one (21) of these institutions (which are now defunct) have a total of one hundred and thirty million, three hundred and eighty-eight thousand, five hundred and sixteen Ghana cedis, sixty-two pesewas (GHc 130,388,516.62).

The remaining ten (10) existing financial institutions are holding a total of fifty million, four hundred and eighteen thousand, three hundred and seventy-three Ghana cedis, and ninety-eight pesewas (GHc 50,418,373.98) in locked-up funds belonging to members of the CUA.

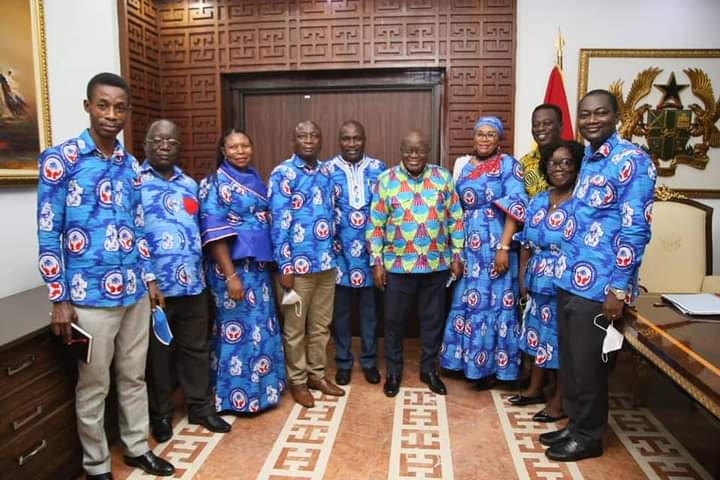

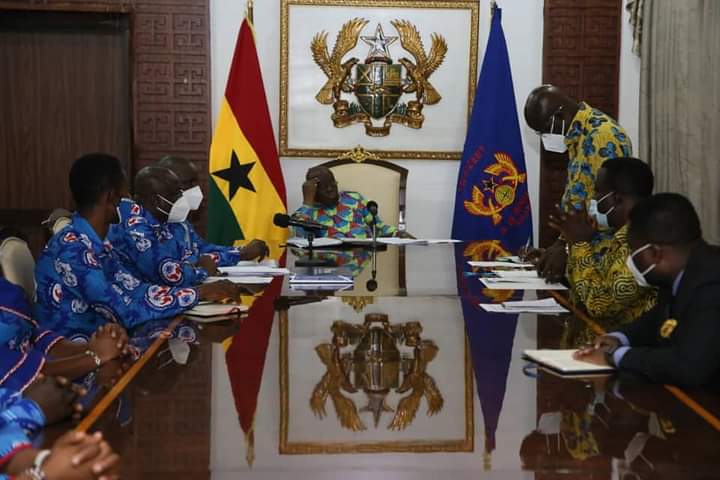

Addressing President Akufo-Addo at the Jubilee House today the 28th of June 2021, when they paid a courtesy call on him, President and Chairman of the CUA Board, Dr. Bernard Bingab, said while the CUA recognizes the intervention of government as a result of the financial sector clean-up, members of the CUA are struggling because a significant part of their investment funds is locked-up.

Coupled with the effects of the novel coronavirus, COVID-19, the CUA has sought support from the Ghana Enterprises Agency (GEA) in the government’s COVID-19 alleviation fund but has not received any positive feedback to date.

“For this reason the Board of CUA wants to appeal to His Excellency the President, to support the credit union through CUA to address the challenge faced by the unions in this trying moment,” Dr. Bernard Bingab said.

CUA Locked-up Funds

In his brief, Dr. Bernard Bingab noted that the Credit Union’s legislative instruction, LI 2225 (2015) is to allow the credit union movement to continue to play the role it has always played in the economy, but from a position of greater strength, safety and soundness. The legislation, among other things, the CUA board Chairman said, will “encourage greater prudence in the management of loans granted by the credit unions; ensure adequate capital; provide greater guidelines for investment activities of credit unions; and ensure more effective corporate governance system”.

“Unfortunately, the LI 2225 since its passage in 2015 has not been operationalized. Several efforts have been made by CUA in engaging the relevant state institutions in operationalizing the law.

“Except to say that quite recently, the Honourable Minister for Finance has in principle accepted that CUs need to be regulated because regulation is the function of the state. We, therefore, seek the kind intervention of the high office of the President of the Republic of Ghana towards regulating CUs in Ghana as done in sister countries, like, The Gambia and Kenya,” Dr. Bingab stated.

“We also notice that there exists a couple of laws that govern the regulation of Credit Unions, the Co-operative Decree, Bank of Ghana Act and the non-Banking Financial Act. These laws are Multi-Sectoral and therefore need to be harmonized to make regulation smoother,” he added.

Akufo-Addo’s Response

President Akufo-Addo in response to the submission of the CUA Board chair noted that he agrees with the suggestion that there is the need to harmonize all the laws found in the Co-operative Decree, Bank of Ghana Act, and the non-Banking Financial Act into a single law that will regulate the credit union sector.

On the locked-up funds, President Akufo-Addo relied on available data on the ongoing liquidation process of the financial institutions in question and assured the CUA that their funds will be released to them “as soon as possible.”

The CUA

CUA is the umbrella body of all Co-operative Credit Unions in Ghana. It provides an enabling environment for financial and other technical services to reach its members and also ensures that the Credit Union concept is promoted properly.

CUA exists to regulate and supervise all Credit Unions in the country on behalf of the Bank of Ghana and other interested groups for sanity to prevail in the market.

The CUA is a member of the Ghana Microfinance Institutions Network (GHAMFIN). The CUA co-operates with the Department of Co-operatives of the Ministry of Employment and Social Welfare and the Ghana Co-operative Council.

Source: Mybrytfmonline.com