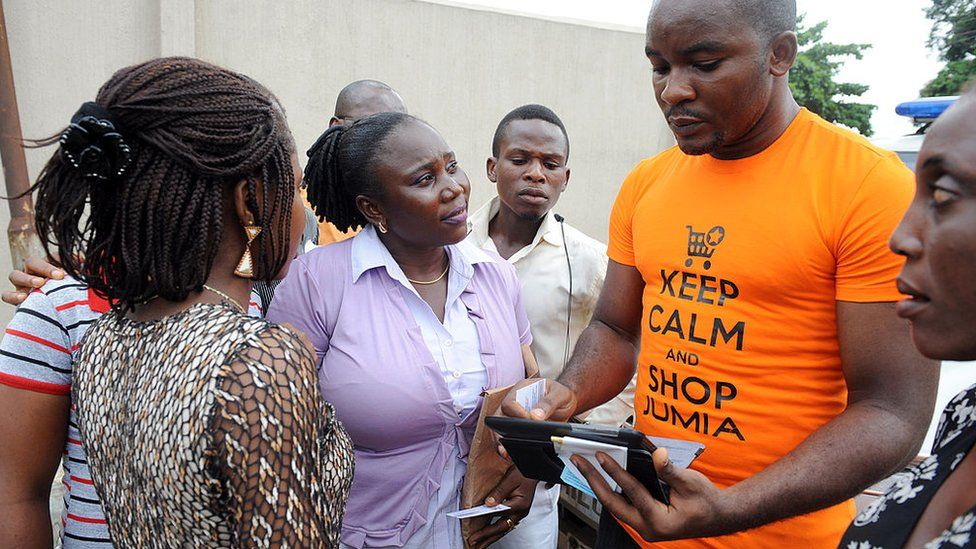

It could not have got off to a much better start for Jumia’s historic stock market listing. The hoopla on the day it became the first Africa-focussed tech firm to list on the New York Stock Exchange was massive.

International media took note and investors piled in, its share price rose more than 70% in value on the day but the excitement would prove to be short-lived.

“In our countries where we operate there are 700 million people and last year we served more than four million consumers” co-chief executive officer Sacha Poignonnec told the BBC on the floor of the stock exchange.

When I sat down to speak with his co-CEO, Jeremy Hodara, in September the firm had had a humbling few years. Share prices plummeted and came back, backers had bailed out, and it had withdrawn from trading in three of the fourteen countries it was operating in – and that’s not to mention reports of fraud lawsuits in New York courts and a public relations disaster over its identity.ADVERTISEMENT

But the promise of millions of consumers newly connected to the internet has not gone away and neither has interest in Jumia which is still by far the largest e-commerce company focussed on the African continent – although its management and much of technical expertise is based outside of Africa.

By 2030, consumer spending across Africa is expected to reach $2.5tn. Jumia still sells goods in 11 of those countries. It operates a marketplace where thousands of other businesses sell goods on its platform and has a finance arm, Jumia pay, so customers can go about their shopping, pay utility bills and order pizza, all without leaving the Jumia’s platforms.

A mixture of leaving unprofitable markets and a new interest in e-commerce spurred by the pandemic has seen Jumia’s share price return to levels seen on the day of its stock market debut.

“Overall, e-commerce on the continent is still very small compared to traditional retail,” Mr Hodara says, when asked why the Jumia ride turned out to be so bumpy. “It’s a long journey and the opportunity is massive. So, we’re taking it step by step.”

While the platform first became known as a place to buy electronics, consumers usually only make these kinds of purchases a few times a year, so the firm is now trying to attract consumers to buy everyday items like groceries and clothing..

“Those products generate more profit than the electronics that were purchased before,” Mr Hodara says.

“We generate almost $1 of profit when we deliver an order after all the logistic costs. What we want to do now is invest more into growth in two areas: tech and marketing. This is the direction we’re taking now that we feel comfortable and confident about the profitability and unit economics of our business.”

Plans to continue aggressive spending on advertising and tech mean that Jumia’s high operating expenses could alarm investors. So when will it finally post a profit?

“We’re not communicating a timeline, but we’re working on posting steady results,” replies Mr Hodara.

Addressing the different needs of fragmented markets around the continent is a key challenge for any pan-African business. While the opportunity in Africa is framed as being continent-wide, I ask Mr Hodara if the reality is more nuanced.

“Serving consumers in Egypt is not the same as serving consumers in Nigeria, and working with sellers in Morocco has nothing to do with working with sellers in Kenya,” he says.

“The way you have to operate is very local, navigating the specificities of those countries, while at the same time keeping economies of scale through technology processes.”

With two French founders and its senior leadership based outside the continent, Jumia’s credentials as an “African” firm have been questioned. Mr Hodara says Jumia chooses not to engage with that controversy as it is neither “fair or relevant”. But, is it not relevant to consumers on the continent, I ask?

“Our consumers are African, our sellers are African, our employees are African, we’re creating hundreds of thousands of jobs on the continent,” he replies. “We’re opening a tech centre in Cairo, Egypt, we’re going to have about 100 developers there and we’re going to do more of that. Our mission is Africa.”

Besides Jumia there are three other so-called “unicorns” – privately held tech companies valued at more than $1bn – in Africa, compared to 100 in China and 200 in the US.

Despite that, the possibilities on the continent are enormous. A youthful and growing population, rising internet penetration and investments in digital infrastructure point to even greater opportunities, if an enabling environment is nurtured further.

Google recently announced plans to invest $1bn in internet connectivity and startups in Africa, adding to the billions already being spent on infrastructure projects to bring online access to more people.

Mr Hodara says the willingness to face the challenges for e-commerce in Africa early on is what creates the opportunity for Jumia to continue to lead in this space.

“The complexity of operating on the continent means we have unique barriers to entry that make it very hard for anyone else to do what we are doing,” he says.

While other e-commerce startups have popped up around the continent, Jumia still has the most customers, with 10 million more monthly visits than its closest contender, South Africa’s Takealot.com.

The rise of e-commerce in Africa appears inevitable, but early starters like Jumia will need adoption by consumers to be rapid enough to aid their own success, rather than that of their successors.

Source: BBC