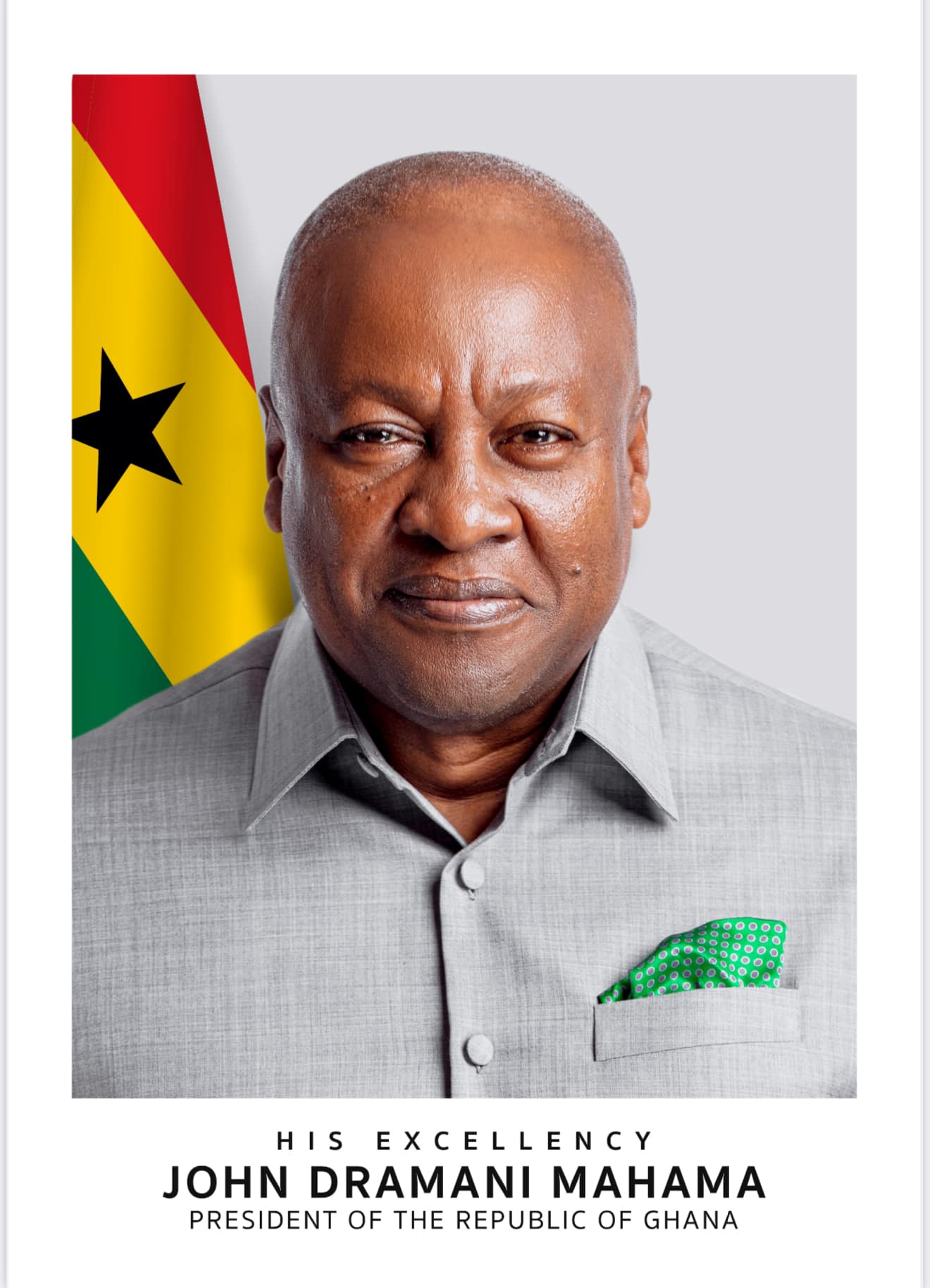

The Minister for Finance, Dr. Cassiel Ato Forson, has expressed strong confidence that President John Mahama will promptly sign into law the recently passed bill that eliminates the E-Levy, Emission Levy, and Betting Tax.

The decision by Parliament to repeal these taxes is seen as a major relief for businesses, individuals, and industry players who have long decried the financial strain imposed by these levies.

Following the bill’s passage, Dr. Ato Forson took to social media to reaffirm his expectation that the President will act swiftly.

“Parliament has just passed the Income Tax (Amendment) Bill, 2025, which abolishes the ‘Betting Tax’ and other levies. I have no doubt that H.E. President John Dramani Mahama will be more than willing to sign it into law without delay,” he posted on March 26.

The Emission Levy, introduced in 2024 to promote environmental sustainability, faced strong opposition from vehicle owners and businesses, who argued it placed an unfair financial burden on them. Similarly, the 10% Betting Tax, aimed at generating revenue from the growing gambling industry, was met with criticism, with stakeholders arguing that it discouraged participation and hurt operators’ earnings.

The removal of these levies is expected to reduce tax burdens on multiple sectors while influencing future income tax structures and corporate taxation policies.

Government Moves to End 1D1F Tax Exemptions

Meanwhile, Dr. Ato Forson has announced that the government will discontinue tax exemptions under the One District, One Factory (1D1F) initiative, citing widespread abuse of the policy.

Speaking before Parliament, the Finance Minister stated that evidence had shown significant misuse of the exemption scheme, prompting the decision to halt it.

“As Finance Minister, I’m not going to continue with the 1D1F tax exemption because the evidence before this House suggests it has been abused badly,” he declared.

While acknowledging that the initiative was originally designed to boost industrialization and economic growth, he noted that its loopholes had been exploited in ways that undermined its purpose.

Dr. Forson reassured Parliament that the government remains committed to supporting local industries but will adopt alternative measures to ensure fairness and accountability.

“We will support genuine businesses that contribute to our economy, but we must put an end to policies that create loopholes for exploitation,” he emphasized.

The repeal of these levies and the policy shift on tax exemptions signal a major transformation in Ghana’s economic strategy, with the government aiming to balance revenue generation with economic growth and fairness.

Source:Mybrytfmonline.com/Gumedzo Isaac Acheampong