In 2001, air travel was dealt a massive blow by the 11 September attacks, and the effects lasted years. But this was a ripple compared to what Covid-19 will do.I

In the heart of Australian outback lies Alice Springs. The town – colloquially known as Alice – is the site of indigenous human presence dating back nearly 30,000 years. More recently, however, a new (and admittedly very different) type of settler has descended upon Alice. Since April, four Airbus A380s have made their way to the small town. The 500-plus-tonne behemoths belong to Singapore Airlines which, like many other carriers, has grounded almost its entire fleet.

The reason is Covid-19. The spread of the novel coronavirus has caused passenger demand to collapse, forcing airlines to park, rather than fly, their planes. Alice offers conditions ideal to do just that. The local airport has a runway long enough to land commercial airplanes and the climate is dry, which means aircraft parts corrode far slower than in the sweltering heat and humidity of South East Asia.

Slumps in travel demand aren’t new. Following the terrorist attacks of 11 September 2001, passenger enthusiasm towards flying also waned amid security fears. This forced airlines – then, like now – to cancel flights and puts planes into storage. The industry did recover. Passenger numbers for 2002 were 1.63 billion, only slightly lower than the 1.66 billion who flew in 2001. But passenger numbers don’t tell the whole story.

The 9/11 attacks also forced airlines to trim costs through furloughs, layoffs, and most notably, consolidation. Prior to the attacks, the US airline market – the world’s most lucrative – was largely controlled by eight carriers. Today, its four. Following the attacks, airlines also became more cautious and shelved plans for aggressive expansion. This led to fewer flights overall and for passengers, less space as planes got fuller.

Whether Covid-19 has a similar impact on the industry and how passengers fare in the aftermath will depend on a few things.

The collapse in air travel demand has been driven largely by public policy. As Covid-19 spread, governments worldwide chose – in the interests of preserving public health – to ban entry to non-residents. Some countries like India, Malaysia and South Africa stopped issuing visitor visas. Others like the Australia, New Zealand and the United States suspended visa-free travel reciprocity. The move not only ended the plans of millions of travellers but also forced airlines to stop serving once-lucrative markets. Flying empty planes around makes little fiscal sense. Consequently, getting planes back in the air will require an easing of government entry restrictions.

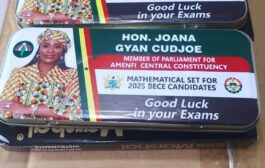

Some of Singapore Airlines’ aircraft now sit at Alice Springs Airport in Australia to prevent corrosion.

There are some signs this is happening. The South African government recently announced efforts to reopen the country’s tourism sector. With one exception. The move only applies to domestic travellers; international tourists will have to wait a bit longer. Mmamoloko Kubayi-Ngubane, South Africa’s minister for tourism, says: “The decision to open the country’s external borders will be based on an ‘assessment of scientific evidence… guided by (the government’s) responsibility to protect the lives of South Africans’.” Kubayi-Ngubane’s words reflect the delicate balance governments must strike between delivering for citizens the economic benefits of tourism while protecting those citizens against the public health risks of Covid-19.

But there might be a way around these travel restrictions: “travel bubbles”. Colloquially known as “coronavirus corridors” or “air bridges”, the underlying idea is simple. Rather than banning visitors outright (or relegating them to quarantine), some countries agree to open their borders to one other while – in principle – keeping their borders to all other countries closed. Signatory countries would typically be ones where the coronavirus threat has been contained. This minimises transmission risk for travelers within the bubble while preventing the importation of new cases from outside.

When it comes to testing, accuracy is everything

The UK government recently moved to do just that. Starting 10 July, passengers from over 50 countries will be allowed to enter England, sans quarantine. In announcing the move, Prime Minister Boris Johnson said: “Instead of quarantining arrivals from the whole world, we will only quarantine arrivals from those countries where the virus is sadly not under control.” But the effectiveness of travel bubbles depends in part on the goodwill of citizens. The success of the UK’s travel bubble with France requires that visitors to the UK do not travel to a high-risk country (say the United States, for example) and then in short order, fly to England via France. How authorities prevent this from happening remains unclear. The situation is particularly precarious if there are no border controls between countries inside the bubble, as is with the case with EU member states.

Another workaround involves having rapid testing infrastructure in place. The move would allow authorities to screen passengers for the virus and if needed, quarantine these individuals. Researchers at Stanford University recently launched a study to examine the concept’s viability. The work – which is being conducted in collaboration with the Taiwanese government – will test passengers for signs of the virus on flights across the Pacific. According to the study’s authors, “the goal of the experiment is to figure out the earliest time we can release people if they get tested”. That matters to countries who see air travel as key to jumpstarting the economy.

The pandemic has meant passenger numbers across the world have diwnled to almost nothing.

But when it comes to testing, accuracy is everything. Imagine sitting near someone who tested negative for the virus but was actually infected (and infectious) during the entire flight. The idea is not entirely far-fetched. Studies suggest that one in three infected people can receive so-called “false negatives”. According to Maureen Ferran, a professor in biology at the Rochester Institute of Technology in New York, false negatives can occur when nasal swabs – used to collect samples of the virus – aren’t inserted deep enough into the nose or don’t collect enough of the virus sample. She says false negatives are also possible “if a person is tested too early or too late during their infection and there isn’t a lot of virus in their cells”.

A vaccine for Covid-19 would provide relief. Vaccines strengthen the body’s natural defences, lowering the risk of infection and transmission. This curbs the need for entry restrictions, travel bubbles or virus tests altogether. But finding a vaccine isn’t easy. Antidotes to some life-threatening illnesses like HIV and malaria have remained elusive despite decades of research.

Service-cutting is about limiting so-called ‘touchpoints’: opportunities for Covid-19 to spread via close physical proximity between flyers and crew

When vaccines have been found, the process has been painstakingly long. The vaccine used to treat measles took nearly a decade to develop and hit the market 50 years after US healthcare providers starting monitoring the disease. Even if a vaccine for Covid-19 is found, it must be mass produced and distributed worldwide, which will take even more time. For travelers, this means the pre-Covid-19 flying experience isn’t likely to return anytime soon. So what can passengers expect in the meantime?

Pre-Covid-19 flyers – particularly those sitting in the premium cabin – were treated to all kinds of perks; amenity kits, noise-cancelling headphones and pyjamas. Some airlines went even further, offering passengers gourmet meals prepared by professional chefs onboard. Those days are over. Instead, flyers can expect pared down service with few if any luxuries. Airlines are axing inflight-magazines, pillows and in some cases, even meals. Singapore Airlines – a carrier long admired for its customer service – suspended serving a trolley meal service for flights within Asia. Passengers will instead be given a snack bag with water and refreshments during boarding.

The reason isn’t so much cost (though airlines, already hemorrhaging cash, are keen to make savings). Rather, service-cutting is about limiting so-called “touchpoints”: opportunities for Covid-19 to spread via close physical proximity between flyers and crew. Serving passengers in cramped spaces requires considerable person-to-person interaction. Airlines want to limit those interactions to stop the virus from spreading.

Many airlines have already curtailed some services to reduce person-to-person contact.

Some carriers are taking virus containment efforts one step further by requiring flyers to wear masks and face shields on board. One such airline is Qatar Airways. The airline’s chief, Akbar Al Baker says these measures are needed to “ensure the continued health and wellbeing of […] passengers and cabin crew”.

Conventional wisdom suggests that when passenger demand drops, fares follow. So with passenger numbers at record lows (as of April, Heathrow passenger numbers were down 97%), the quest for cheap tickets should be much easier. But that’s not the whole story. Fares are also influenced by the number of seats in the global market. With the world’s passenger planes largely grounded (one estimate suggests nearly 30% of the world’s 26,000 commercial jets are stuck on airport tarmacs worldwide), there are far fewer seats to go around. This gives airlines rather than passengers the upper hand when it comes to setting fares.

Fare hikes in the short run aren’t likely, according to Severin Borenstein. Borenstein – a professor at the University of California Berkeley’s Haas School of Business – thinks that fares are more “likely to remain quite moderate, because fuel costs are low and the airlines are flying more capacity than demand can support”. However, he points out that the absence of a Covid-19 vaccine could cause fares to eventually rise albeit, “over multiple years”.

Fare hikes are also likely if some airlines go bankrupt. Bankruptcy reduces the number of competitors in a market, which invariably drives up price. The prospect of a major airline going out of business is something aeroplane manufacturer Boeing recently warned about. Similar sentiments have been expressed by Emirates’ chief Tim Clark.

While ‘high density seating’ may save flyers cash, the concept is antithetical to social distancing

And running an airline is pricy. Even small jets, like the single-aisle Boeing 737, can cost upwards of £80m ($102m) apiece. Add to that fuel, insurance and taxes and you’re talking about serious money. With annual expenses running into the billions, airlines need cash to survive – lots of it. Moving cargo around is one way to make money. Another involves partnering with banks to sell airline-branded credit cards. Yet, the best way to generate cash remains filling passenger cabins.

Maximising the so-called load factor is particularly important for budget airlines who – despite incurring similar costs as their full-service competitors – offer substantially lower fares. A one-way ticket on Irish budget giant Ryanair averages just €37 (£33.50/$42); you’d be hard pressed to find fares that low on many of Ryanair’s competitors.

Budget carriers offset lower fares by squeezing more passengers into their cabins. Ryanair packs 189 flyers onto its jets, 10% more than flag-carriers who fly the same airplane. Yet while high-density seating may save flyers cash, the concept is antithetical to social distancing. And that’s a problem. When it comes to fighting Covid-19, the US Centers for Disease Control and Prevention calls social distancing, “one of the best tools we have to avoid being exposed to this virus and slowing its spread locally and across the country and world”.

Airports were closed down completely for a few days after the 9/11 attacks – and the effects of the temporary shutdown were felt for years (Credit: Getty Images)

This sentiment is shared by some lawmakers, who now mandate that airlines fill no more than two-thirds of the passenger cabin. Borenstein says limiting passenger capacity could disrupt the model of budget carriers, “because they rely on higher density on the aircraft and because those airlines tend to have weaker capitalisation, and therefore be more exposed to demand drops in their finances”. No wonder low-fare carriers have panned the move.

Airbus chief executive, Guillaume Faury, has called the Covid-19 pandemic, “the gravest crisis the aerospace industry has ever known”. Similar sentiments have been expressed by the International Air Transport Association. The trade group – which represents nearly 300 airlines – says the industry is “only at the very beginning of a long and difficult recovery” and there remains “tremendous uncertainty about what impact a resurgence of new Covid-19 cases in key markets could have”.

Put simply, the industry will recover, but when that happens air travel is likely to look very unfamiliar.

Source: BBC